Through unending announcements, interviews, and posts on his social media platform, Truth Social, the US president, Donald Trump, ensures his presidency saturates global news headlines.

On 2 April, so-called “Liberation Day”, he unveiled a string of “reciprocal tariffs”, and the UK was not exempt. But then neither were the Heard and McDonald Islands, Antarctic outposts to the southwest of Australia, home only to penguins.

This scattershot approach might explain why UK business owners are, according to This is Money, more concerned about the tax fallout from last year’s Autumn Budget than announcements emanating from the White House’s Rose Garden.

Amid global uncertainty and volatile markets caused by Trump’s tariffs, the Guardian reports that UK business confidence currently sits at its lowest level in more than two years.

So, what, if anything, should you be concerned about as a UK business owner in 2025, and how might financial advice be able to offer guidance and much-needed reassurance?

Keep reading to find out.

Inflation, interest rates, and the overall tax burden are the biggest concerns for UK businesses

This is Money has published the results of a recent YouGov survey into UK business owners’ concerns for 2025 and beyond.

Despite geopolitical uncertainty and market upheaval, UK business owners revealed that their primary concerns were:

- Cutting inflation and interest rates (38%)

- Lowering the overall tax burden (34%)

- Developing a highly skilled workforce (32%)

While the easing of international trade is a worry for business owners, it was the primary concern of just 26% of those surveyed.

Meanwhile, the industry body for the accountancy profession, the Institute of Chartered Accountants in England and Wales (ICAEW), have called 2025’s first quarter “harrowing” for UK companies. Its business confidence index fell to -3.

While recent forecasts have hinted at greater resilience, business owners remain anxious about the economy and about the changes to employer National Insurance contributions (NICs) announced in October, which came into effect from 6 April 2025.

3 current concerns for UK business owners and how advice can help

1. Inflation and interest rates

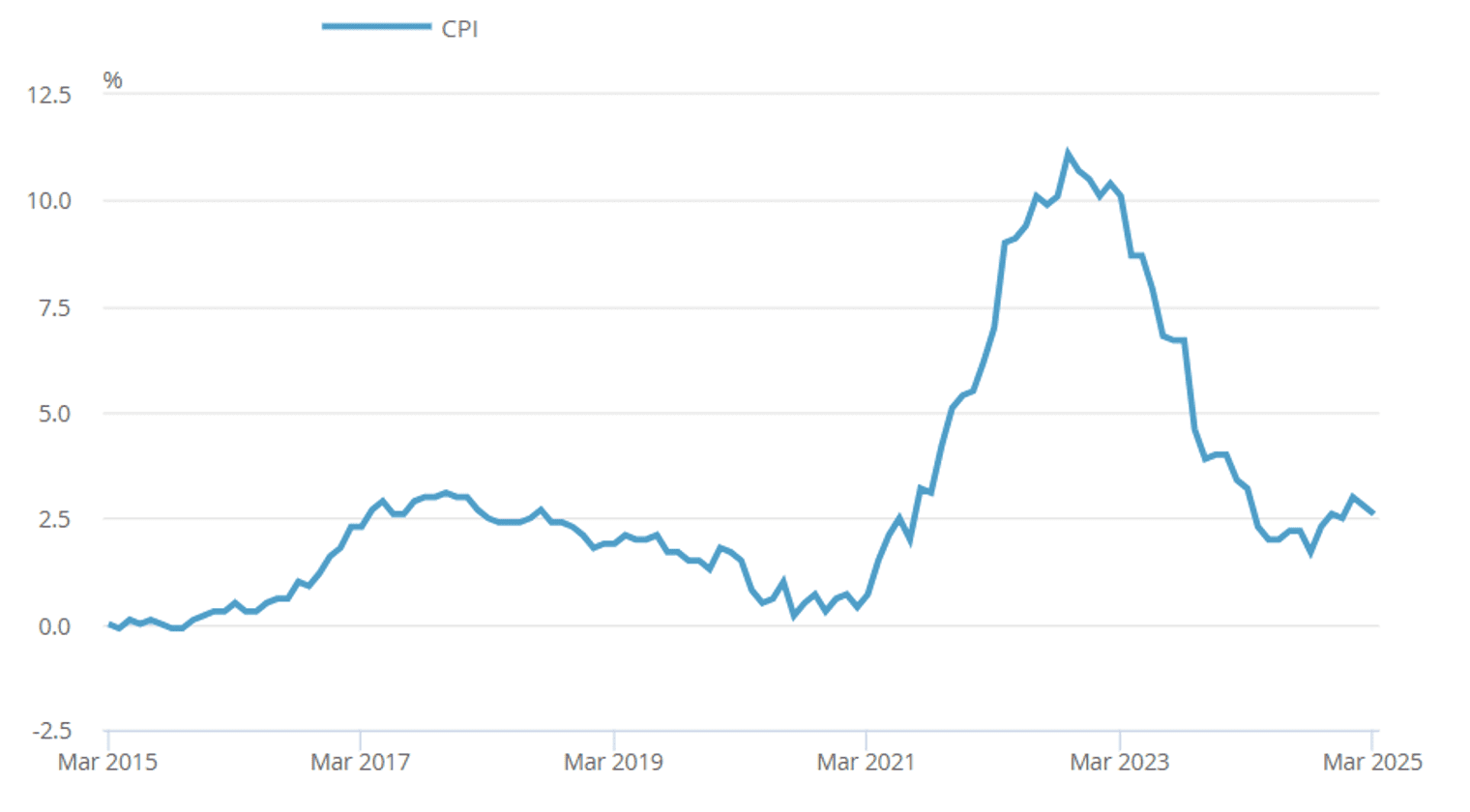

UK inflation reached a 41-year peak back in October 2022 when the Consumer Prices Index (CPI) hit 11.1%.

Source: Office for National Statistics (ONS)

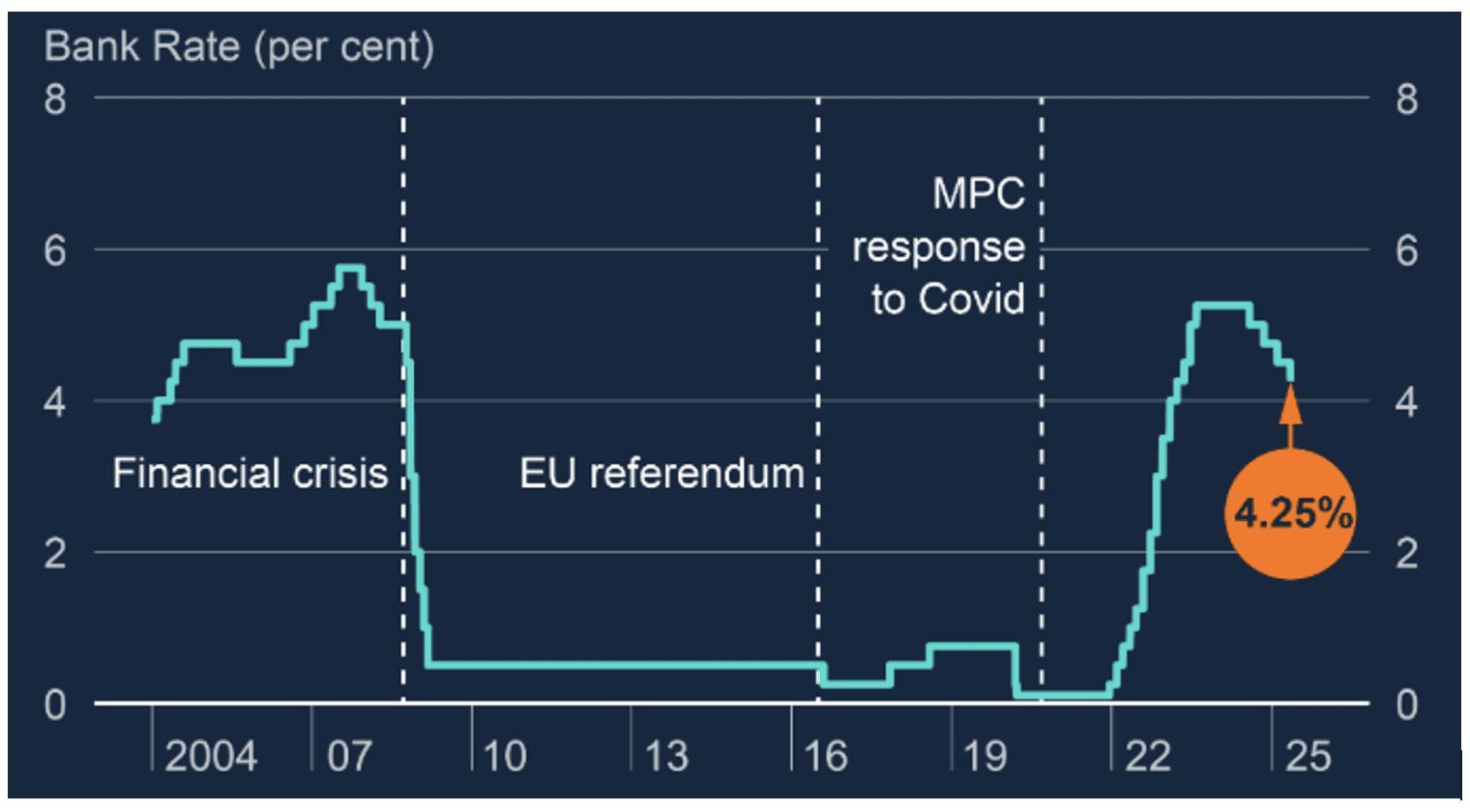

Since then, the CPI has fallen considerably and has remained broadly around the Bank of England’s (BoE) 2% target since April 2024. This relative stability has allowed the BoE to lower its base rate, most recently at the 8 May meeting of its Monetary Policy Committee (MPC).

The MPC voted to cut the base rate to 4.25%, citing easing inflation as the reason for the move. Governor Andrew Bailey was quick to add a warning, which stopped short of namechecking the US president, that “the past few weeks have shown how unpredictable the global economy can be”.

As a UK business owner, the headlines remain positive.

Stabilising inflation means prices for goods, services, utilities, and other overheads are rising more slowly. A drop in the base rate should also lead to reduced borrowing costs, albeit delayed.

2. Changes to employer National Insurance

From 6 April, employer National Insurance (NI) rates increased from 13.8% to 15%. From the same date, the threshold at which employer NI becomes payable was also lowered, from £9,100 to £5,000 a year. The new threshold will remain in place until 2028/29 and then rise in line with the CPI thereafter.

The changes are expected to raise £25 billion a year by the end of 2029/30, with UK business owners footing the bill. But there are mitigating steps you can take.

Consider adopting a business-wide salary sacrifice scheme. Exchanging a portion of their salary for pension contributions effectively reduces your employee’s pay, reducing their Income Tax and NI, while maybe even seeing their take-home pay rise.

Reducing your employees’ gross pay lowers your employer NI payments, too. Savings are based on employee earnings, so encouraging take-up, especially among your business’s high earners, could provide significant savings.

3. A weakening job market

Recent figures from the ONS suggest that the UK job market has weakened at the start of 2025.

The BBC confirms that job vacancies have sunk to their lowest level in nearly four years, as cash-strapped employers faced with rising wage bills are hiring fewer staff.

While pay growth is currently high, the BoE expects a slowdown as the year progresses. With more would-be employees looking for work, the chance to hire the best new talent has increased. And in uncertain and cash-strapped times, an attractive employee benefits package (including the already mentioned salary exchange scheme) could help to attract and retain top talent.

While the economy will continue to be impacted by White House tariffs, creating uncertainty and limiting global growth prospects, there is a glimmer of hope. As a UK business owner, the recently announced UK-US trade deal has seen many tariffs slashed and could help boost economic forecasts for the rest of the year.

Get in touch

Financial advice can provide reassurance, confidence and a sense of control over your business and personal finances, especially if there are areas where the two overlap.

We’re always on hand to offer guidance, so be sure to contact us if you have any concerns about the impact of inflation or interest rate changes on any element of your business. Contact us online or call 020 7400 4700.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future performance. The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates, and tax legislation may change in subsequent Finance Acts. Workplace pensions are regulated by The Pension Regulator.