Recent figures published by PensionsAge highlight a worrying disparity between pension wealth and retirees’ perceptions. Survey results suggest that savers across all wealth bands are underestimating the pension pot they’ll need to secure their desired lifestyle, and often by significant amounts.

It’s a problem that could be more acute for high net worth individuals (HNWI).

For those with more than £250,000 in assets, the average pre-retiree (aged 55 and above) believes they will need around £661,000 for a “comfortable” retirement. The actual figure, though, is more than £1.5 million. This represents a savings shortfall of around £840,000.

Of course, your assets are likely higher. What’s more, you’ll be looking for much more than a merely comfortable retirement. Both factors have the potential to significantly increase the size of your pension shortfall.

Thankfully, professional financial advice can help.

Before we explain how, though, let’s take a look at the survey results in greater detail.

Survey results suggest a wide disparity between the amount retirees believe will provide their desired lifestyle and the reality

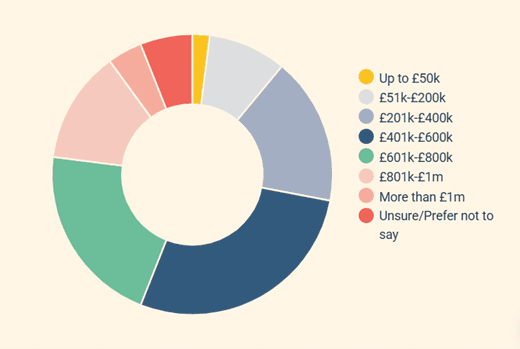

The chart below shows the size of pension pot those with assets exceeding £250,000 think they’ll need for a comfortable retirement.

“Comfortable” in this context aligns with the Pension and Lifetime Savings Association (PLSA) Retirement Living Standards report and includes:

- Basic needs

- Overseas holidays

- Long weekends away in the UK

- Money for day trips, eating out, and social activities

- The financial security to be flexible.

Source: Saltus Wealth Index Report

As you can see, the vast majority of respondents are significantly underestimating the wealth they will need for a comfortable retirement. And if you are expecting to live a “luxury” retirement, you’ll need to factor in this increased expenditure too.

According to PensionsAge, 18% of respondents believe an individual pension pot of between £401,000 and £600,000 will provide a comfortable retirement. But 13% think the figure is even lower – between £201,000 and £400,000.

This obvious shortfall is even more pronounced for younger respondents. When inflation is taken into account, PensionsAge projects pension pots at retirement could be short by as much as £2.5 million.

HNWIs have already taken action to make up potential shortfalls, but they face unique challenges

Interestingly, potential pension shortfalls are already acknowledged by some demographics, including HNWIs approaching retirement.

While the average amount predicted to provide a comfortable retirement is around £660,000, this is already £100,000 short of what the average responder in this age range holds.

For this reason, 69% of HNWIs are planning to increase their pension contributions over the next six months. There is plenty of scope to do this too, as just 8% of all respondents are contributing up to the £60,000 Annual Allowance.

It’s worth noting, of course, that this report looked at individuals with assets over £250,000. As a HNWI with assets totalling £1 million, £5 million, or higher, you’ll face unique challenges.

The size of your accumulated wealth might mean you’ve already used up your Annual Allowance – and possibly that of your spouse or partner, too. Or that the Tapered Annual Allowance has significantly limited your opportunity to make tax-efficient pension contributions.

Where you have outstanding allowance, increasing your tax-efficient pension contributions is a simple and effective way to limit any potential shortfall. But you might need to consider other options.

Remember, not all retirement income comes from pensions, and re-evaluate the support you provide to others

As well as paying household bills and your future self, through pension contributions and investments, you might be providing regular financial support to adult children or grandchildren.

The imperative to support our loved ones exists across wealth bands, but the same rules apply too. You should try to avoid providing financial help that detrimentally impacts your own long-term plans.

Almost three-quarters (73%) of HNWIs provide regular financial support to adult children or grandchildren. Worryingly, 12% of those people are doing so either by dipping into their pension pots or reducing contributions, with serious implications for their retirement.

At HFMC, we can help you understand the likely cost of your dream retirement and calculate any potential shortfall. Once you identify and acknowledge a shortfall, acting upon it becomes easier.

We can help you bridge a retirement gap through increased pension contributions or non-pension means. The latter might include rental income from a property portfolio or tax-efficient investing through Venture Capital Trusts (VCTs), for example. Advice can also help you to juggle financial commitments like supporting loved ones, so be sure to contact us if you think you’d benefit from our expert guidance.

Get in touch

To find out how we can help you make up a potential pension shortfall and enjoy your dream retirement after work, please get in touch.

Contact us online or call 020 7400 4700.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future performance. The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates, and tax legislation may change in subsequent Finance Acts.