While we all strive to live long and healthy lives, native populations in certain parts of the world are more adept at this than others. These longevity hotspots are also known as the globe’s “blue zones”.

As high-life-expectancy regions, the number of centenarians is larger than average, and people generally live longer, healthier, and happier lives.

The five main blue zones are:

- Okinawa, Japan

- Sardinia, Italy

- Nicoya, Costa Rica

- Ikaria, Greece

- Loma Linda, USA.

Inhabitants might have different ideas about exactly what constitutes a healthy lifestyle. But there are some clear similarities in their approaches, too, from regular exercise and balanced diets to a recognition of the importance of maintaining social relationships.

Interestingly, you might be able to take some of the lessons from these communities into your own financial life, specifically into your retirement planning.

Keep reading to find out how you can turn your post-work life into your own financial blue zone.

1. The importance of purpose

On average, Okinawans live longer than the rest of us.

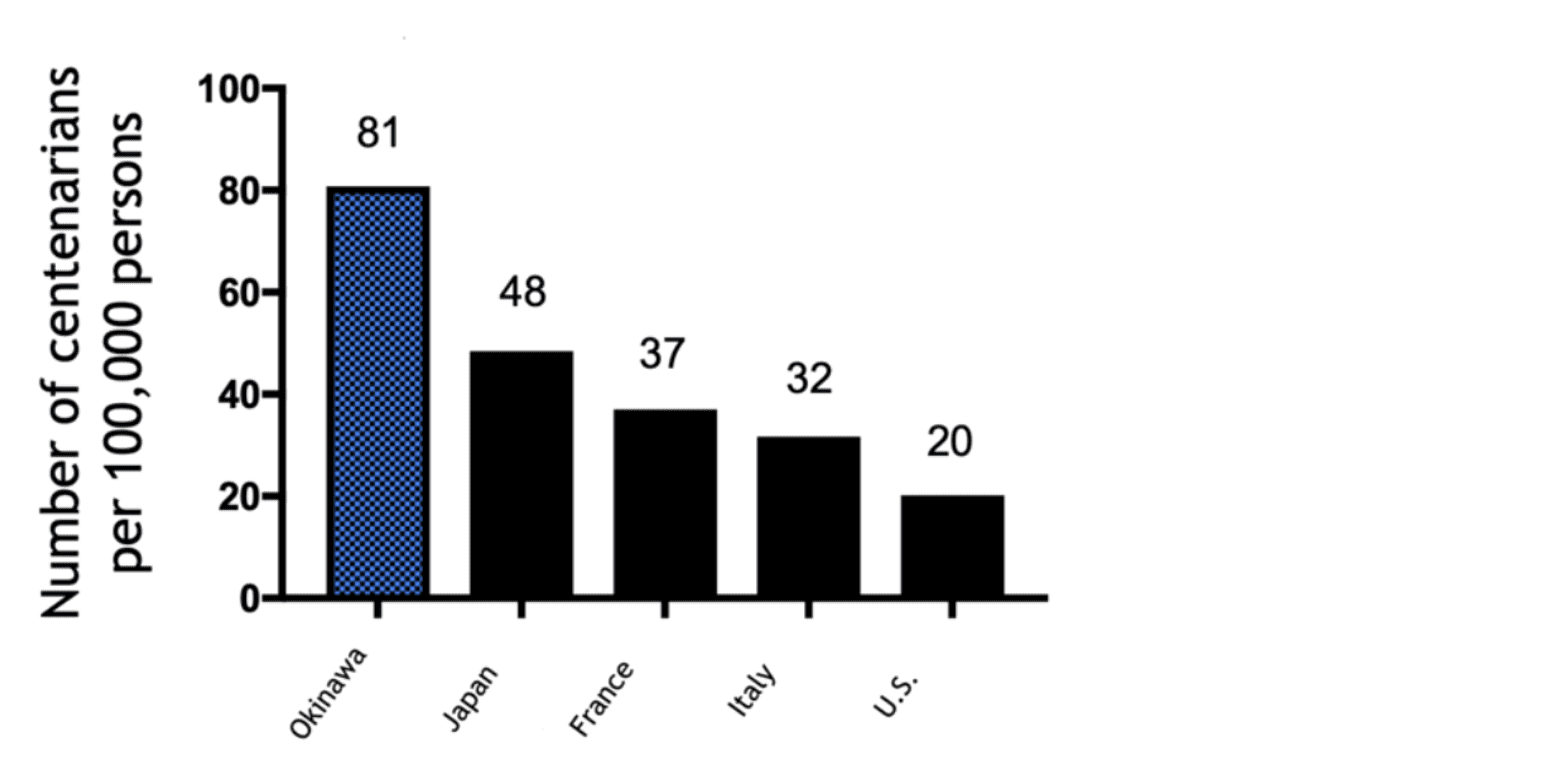

Back in 2021, the World Economic Forum confirmed that one Japanese person in every 1,450 is now aged over 100. And while just 20 in every 100,000 Americans is a centenarian, this rises to 48 for Japan as a whole, and a massive 81 for Okinawa specifically.

Source: World Health Forum

Okinawans enjoy a largely plant-based diet of stir-fried vegetables, sweet potatoes, and tofu. Ingredients high in nutrients and low in calories – combined with a lifestyle built around exercise and movement – mean that rates of cancer, heart disease, and dementia are lower than in other parts of the world, including the US and UK.

Residents of Okinawa also practice the Japanese concept of “ikigai” or “reason for living”. This encourages individuals to find a purpose in life, based on doing things that they love, that they are good at, and that the world needs.

After a long career defined by drive and passion, you can take this same sense of purpose into your retirement.

Think about the things that excite you and base your time around those, whether that’s hobbies, family or travel.

Retirement might be a chance to relax and put your feet up, but you’ll want to ensure your days are full to stave off boredom, loneliness, or even a sense of disappointment. Purpose and intention are key here, so find your ikigai and focus on it.

2. Making “healthy” budgeting choices while dampening extraneous noise

The Loma Linda region of Southern California is largely comprised of Seventh-day Adventists. They combine their religious sense of purpose with vegetarianism, regular exercise, and abstaining from alcohol and tobacco to live long and healthy lives.

Regardless of your religious views, there are several important lessons that you might take from this US blue zone and its inhabitants.

“Money dysmorphia” – a condition that could see you hold an inaccurate view of your wealth – is on the rise in the UK. It can lead to so-called “lifestyle creep” and the tendency to overspend. Equally, you might underestimate your wealth and fail to take the affordable opportunities that come your way.

Money dysmorphia is a modern term for a problem likely exacerbated by social media.

Lives lived online and advertised by walking billboards (the self-styled influencers) create a digital version of a problem once known as “keeping up with the Joneses”. Life comparisons are never helpful but can be especially damaging where your finances are concerned.

Ignore the carefully curated lives of others you see online by taking a leaf out of the Seventh-day Adventist’s book. While the inhabitants of Loma Linda abstain from smoking, drinking alcohol, and excessive indulgence in food or drink, you might opt for a digital detox.

Freed from social media noise, we’ll be on hand to help you focus on your own retirement choices and goals.

3. Regular check-ups and nurtured relationships provide peace of mind

Pension Freedoms turn 10 this year, and the success of the legislation means that your retirement will likely include some degree of flexibility. These non-traditional pension options allow you to access funds as and when you need to, while also placing the onus for budgeting on you.

Managing retirement withdrawals while keeping track of invested funds can be a juggling act. But regular annual reviews provide the opportunity to ensure your plans remain on track.

From checking in with your goals to fine-tuning asset allocations and revisiting your attitude to risk, your retirement isn’t a journey you’ll be taking alone. An ongoing relationship with a trusted adviser – and the wellbeing support of family and friends – can add real value.

The people of Nicoya, Costa Rica, also understand the importance of community. Here, an extended family is key to providing purpose and support into old age, benefiting this blue zone’s centenarians while inspiring the next generation to act likewise.

Get in touch

If you’d like help turning your retirement into a long and healthy financial blue zone, get in touch. Contact us online or call 020 7400 4700.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future performance. The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates, and tax legislation may change in subsequent Finance Acts.